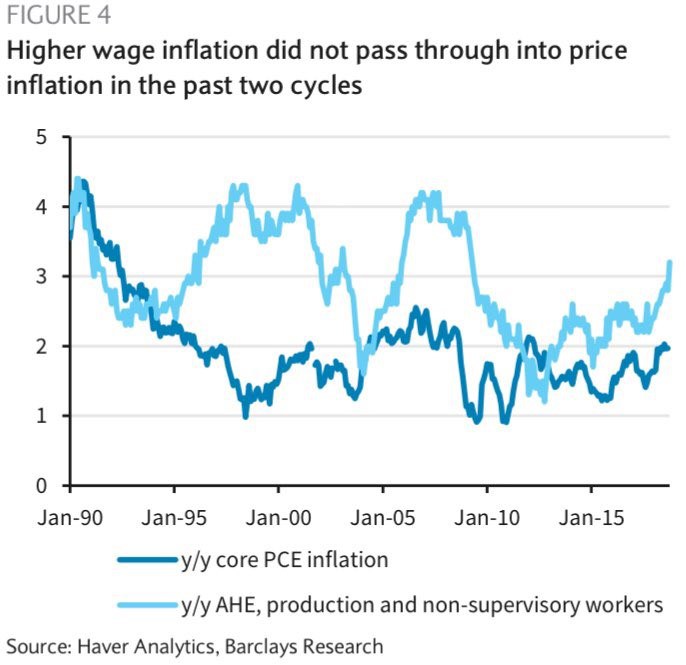

Is the S&P 500 severely overvalued? Look from five different angles! – ProThinker – Analytics for Informed Decisions

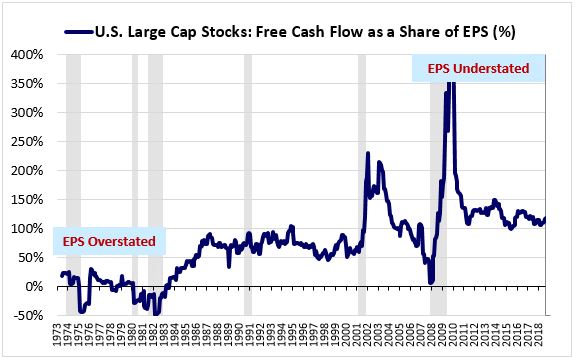

The Earnings Mirage: Why Corporate Profits are Overstated and What It Means for Investors | O'Shaughnessy Asset Management

3rd Greatest PE Decline & How S&P 500 Free Cash Flows Are Spent… | by Vintage Value Investing | Harvest

:max_bytes(150000):strip_icc()/TopETFsthroughDec.22021-7388ec5349294c67b33dc6dc2cb8e171.png)

:max_bytes(150000):strip_icc()/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png)

/Untitled-1-d0efd4e7b7ae44c4827bcfa4976a4629.png)