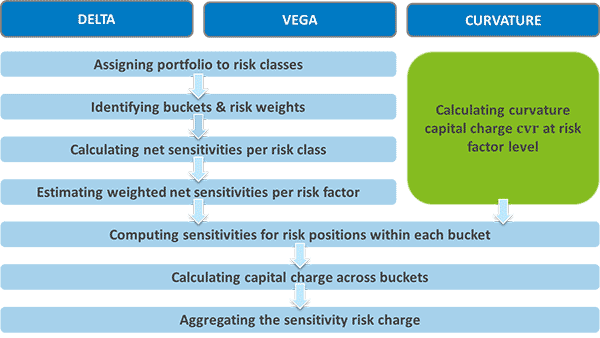

The Fundamental Review of the Trading Book (FRTB): An Introductory Guide - The Fundamental Review of the Trading Book (FRTB): An Introductory Guide - SIFMA

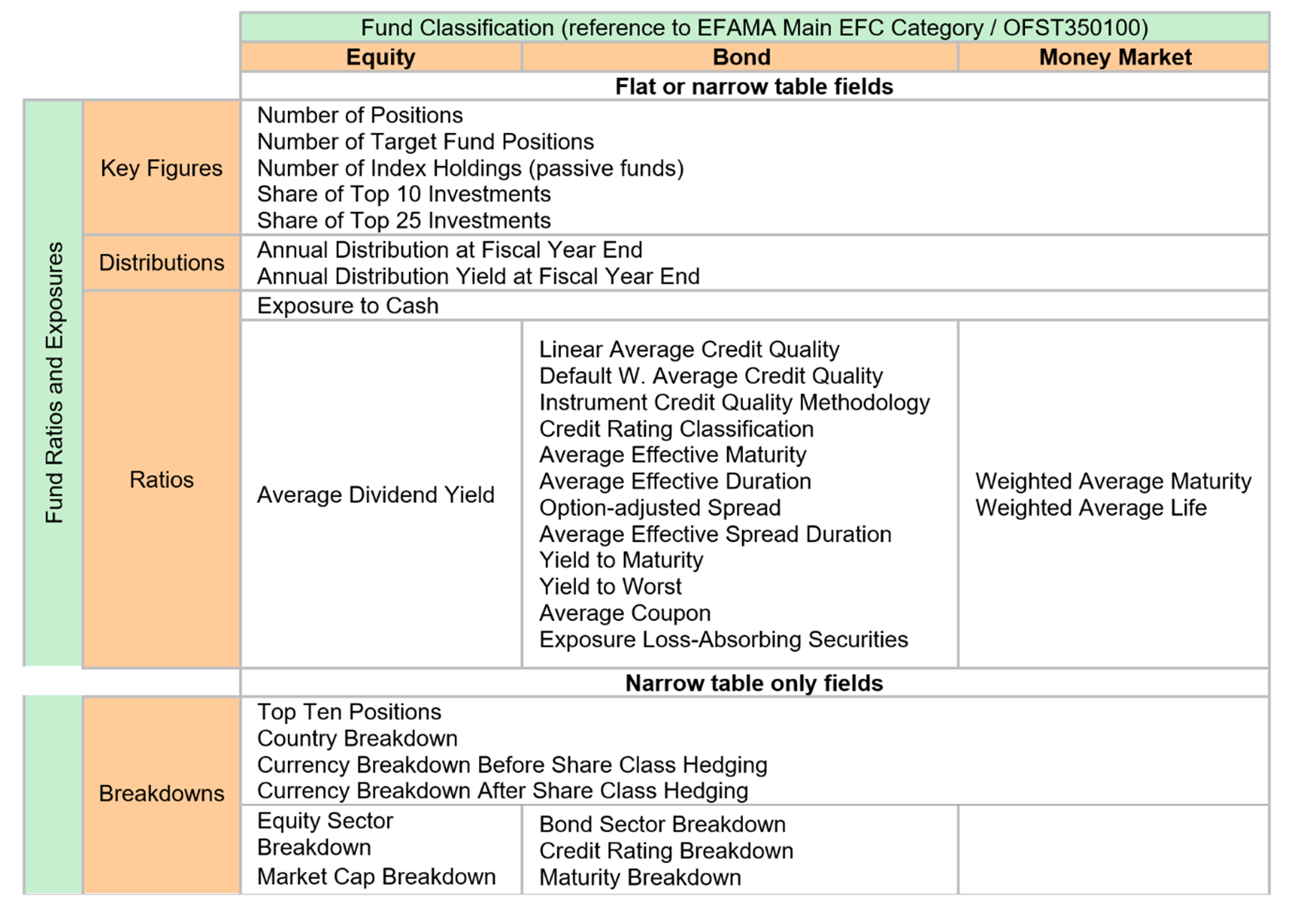

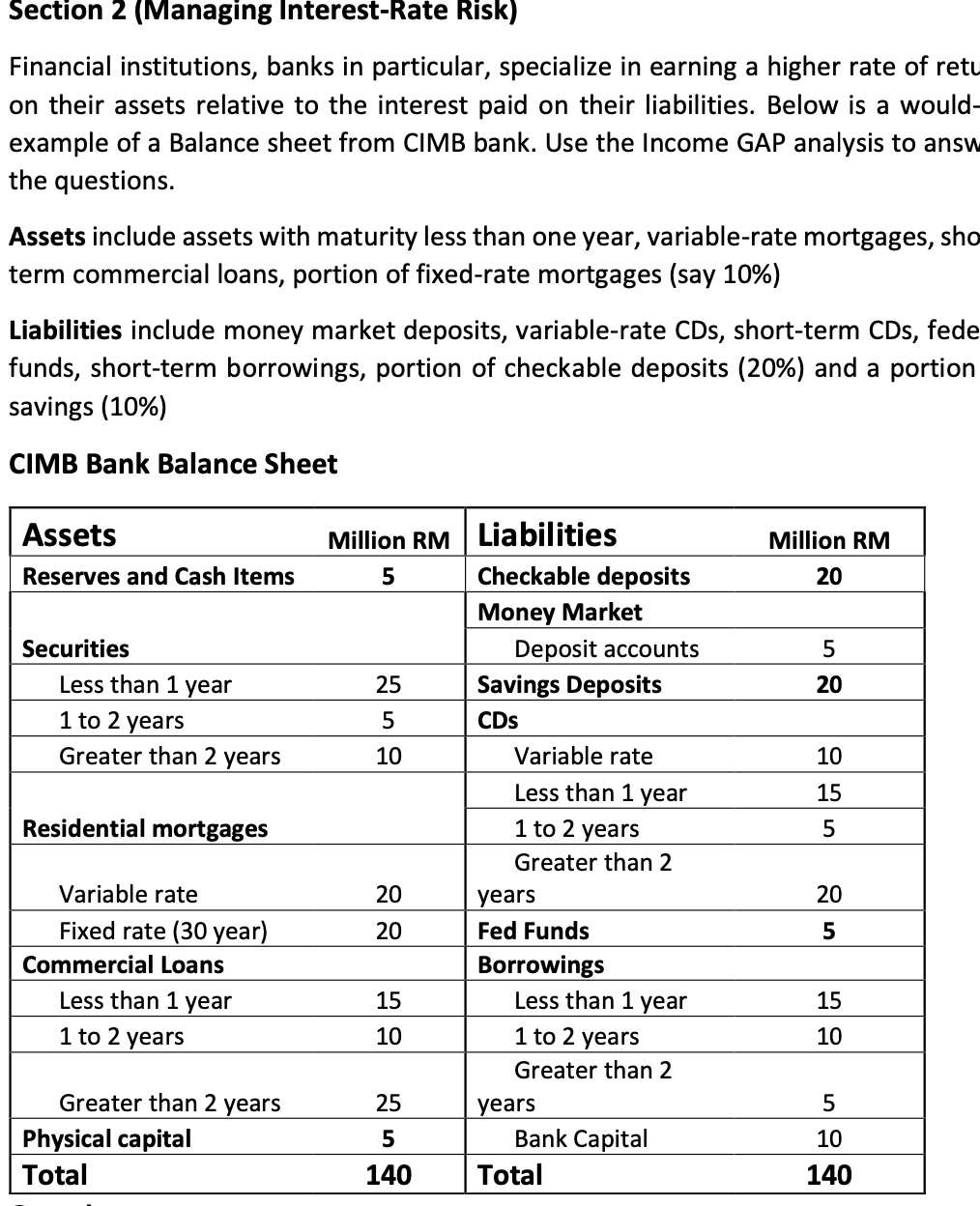

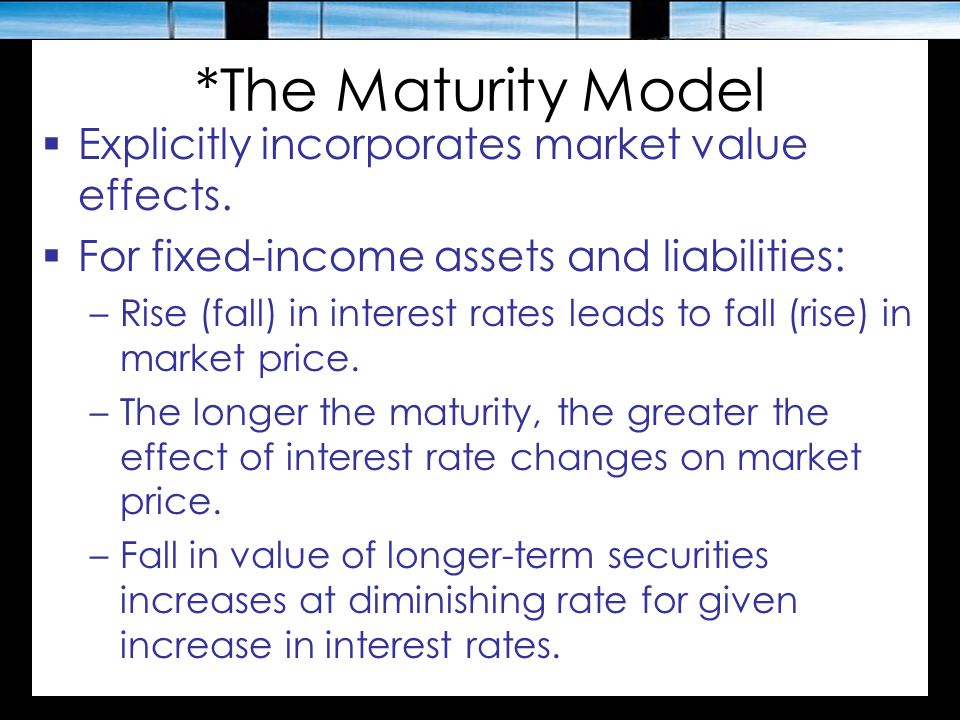

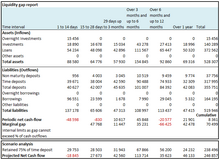

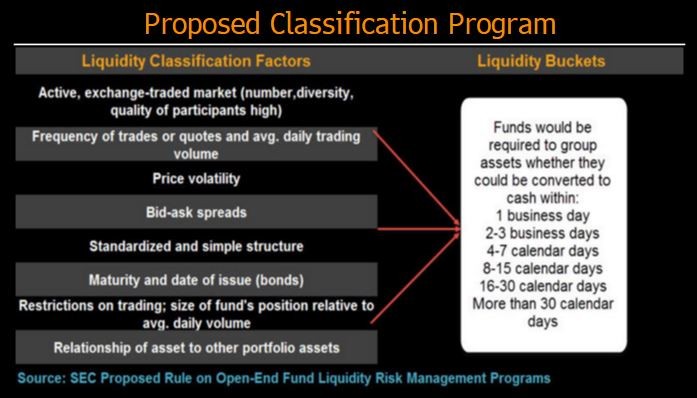

IR RISK, Repricing AND Maturity Model - FINANCIAL INSTITUTIONS MANAGEMENT Master Studies in Finance - StuDocu

Interest Rate Risk I - Solution manual ch8 - Chapter Eight Interest Rate Risk I Chapter Outline - StuDocu

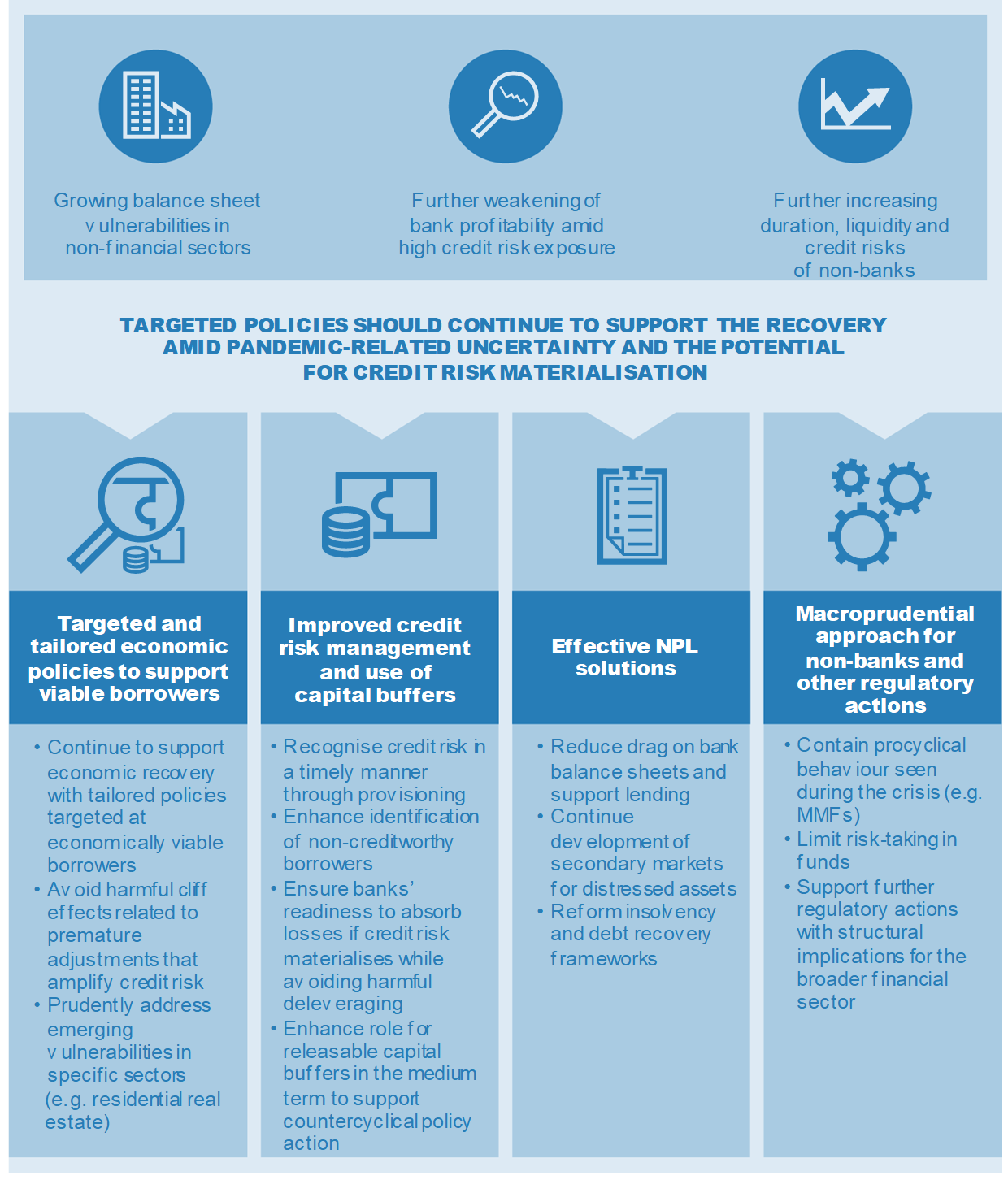

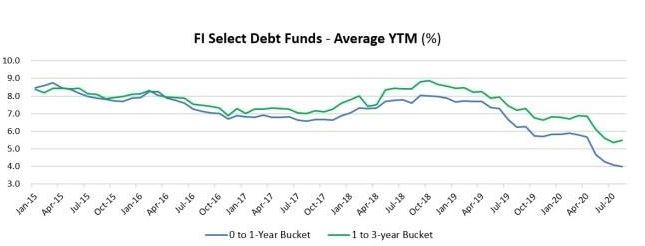

Banks' Maturity Transformation: Risk, Reward, and Policy in: IMF Working Papers Volume 2018 Issue 045 (2018)

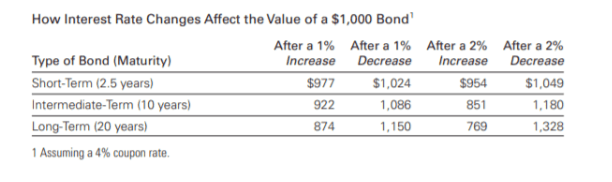

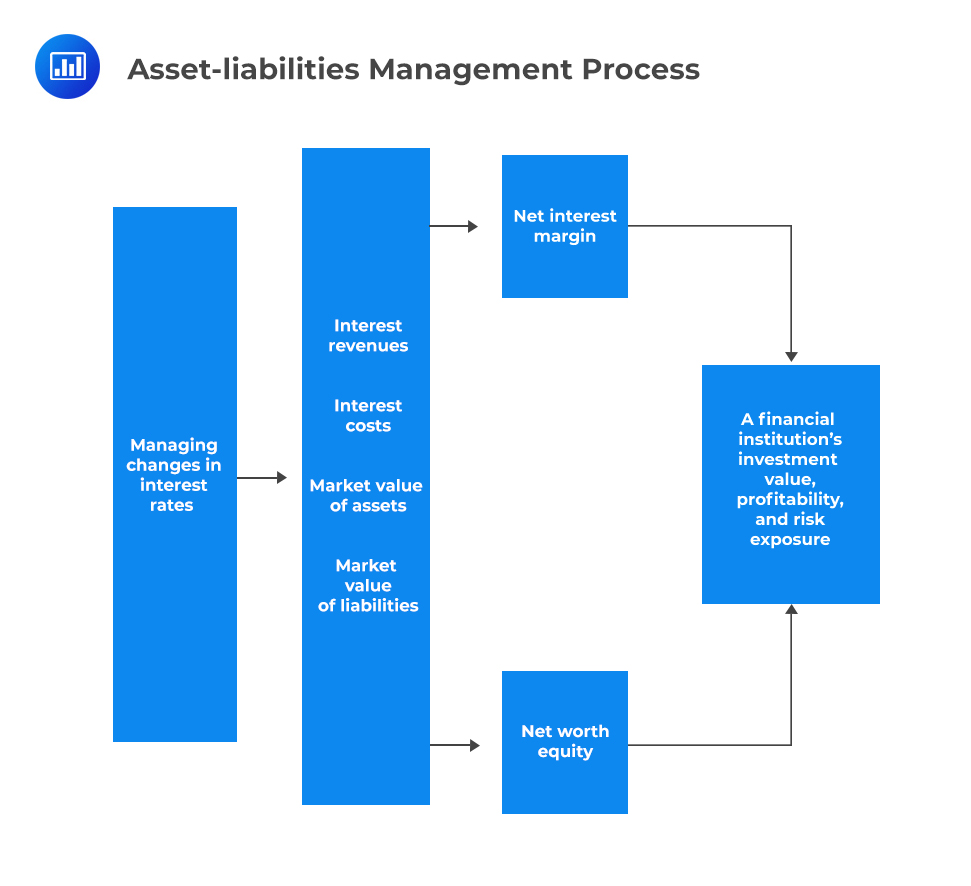

Risk Management for Changing Interest Rates Asset-Liability Management-and-Duration Techniques| AnalystPrep - FRM Part 2 Exam